Reports published Wednesday show a mixed picture of the U.S. economy, and a top official of the U.S. central bank says slow economic growth may continue for a while.

A measure of the services sector of the U.S. economy showed continued growth, but at a slower pace than previously thought. A separate study shows the U.S. trade picture improving, with fewer imports and more exports. U.S. exports have been hampered by the strong dollar, which raises the cost of U.S.-made goods to foreign customers. And a company that processes paychecks says private-sector employment rose 201,000 in May.

We will learn more about the U.S. job market on Thursday and Friday, when government experts report the number of people applying for unemployment aid, the net gain in jobs across the economy, and the unemployment rate.

The jobless rate will probably stay steady at 5.4 per cent, and the economy is likely to show a gain of 220,000 jobs, according to a survey of economists by the Bloomberg financial news service.

The recent blend of both gloomy and positive economic data is complicating the task of the Federal Reserve as it tries to steer the economy toward full employment and stable prices.

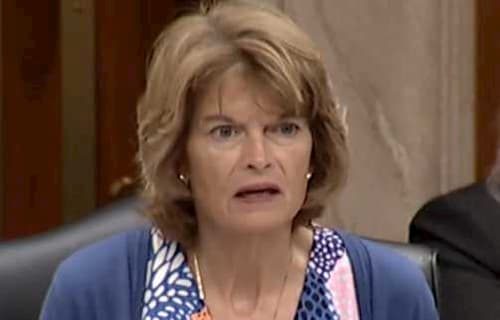

Earlier this week, Lael Brainard, a member of the Fed’s Board of Governors, said the U.S. economy’s weak growth in the first few months may continue longer than many experts expected. The economy contracted at an annual rate of seven-tenths of one percent in the first few months of this year, which was blamed on temporary factors including unusually foul winter weather and labor problems at key ports.

But Brainard says falling oil prices have saved consumers a lot of money, but they are saving rather than spending it. These cautious consumers are not giving the economy the kind of boost many experts expected. She says slower growth in China’s economy and worries about Greece’s debt problems are among the other factors that could hamper U.S. trade and growth.

Brainard and other Fed officials are examining all kinds of economic data as they decide when and how fast to raise the key U.S. interest rate. The Fed slashed rates nearly to zero during the financial crisis in a bid to boost economic growth and cut unemployment.