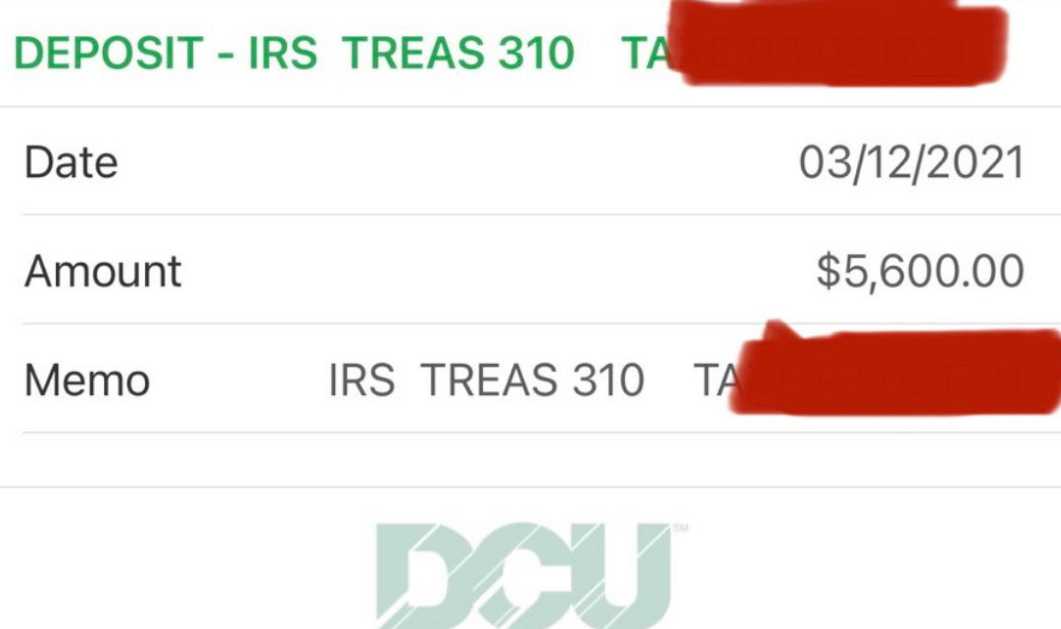

JUNEAU, Alaska — Alaska Department of Labor and Workforce Development issues Form 1099-G to individuals who file for unemployment insurance benefits. Under federal law, unemployment insurance benefits are taxable income and must be reported to the IRS.

Thousands of Alaskans were impacted by the COVID-19 pandemic in 2020 and correctly received unemployment insurance benefits. However, criminal activity has been detected and fraudulent claims were filed using stolen personal information.If you received a 1099-G and did not file a claim, contact the unemployment insurance claim center at one of the following numbers and select Option 3 regarding your 1099-G.

Anchorage: (907) 269-4700

Fairbanks: (907) 451-2871

Juneau: (907) 465-5552

Remote locations: (888) 252-2557

The department must investigate and confirm all reports of fraud before the IRS can be notified. Once the investigation is completed, a corrected 1099-G will be issued. If you do not receive a corrected 1099-G by the time you submit your tax return, the IRS advises individuals to report only the income they have received.

###