“Seniors and families already struggling to afford lifesaving medicines are told to brace for further price hikes by the same industry that saw its profits and shareholder rewards skyrocket by billions in a year.”

An analysis published Tuesday shows that the five largest pharmaceutical companies in the United States raked in combined earnings of $82 billion last year and rewarded investors with billions of dollars in dividends and stock buybacks—all while hiking prices for prescription drugs and fighting federal efforts to curb costs.

An analysis published Tuesday shows that the five largest pharmaceutical companies in the United States raked in combined earnings of $82 billion last year and rewarded investors with billions of dollars in dividends and stock buybacks—all while hiking prices for prescription drugs and fighting federal efforts to curb costs.

The new analysis by the progressive watchdog group Accountable.US finds that Eli Lilly, Johnson & Johnson, Merck, AbbVie, and Pfizer increased their combined share repurchases and dividends by $4.4 billion and $2.5 billion respectively in 2022 as their profits grew by nearly $9 billion compared to 2021.

Last year, pharmaceutical companies raised the prices of more than 1,100 medicines, according to a tally by Patients for Affordable Drugs.

At the start of 2023, drugmakers hiked the prices of at least 350 medicines. While Eli Lilly and other insulin makers announced plans to cut the prices of their most commonly used insulin products earlier this year, they have benefited from decades of harmful price gouging.

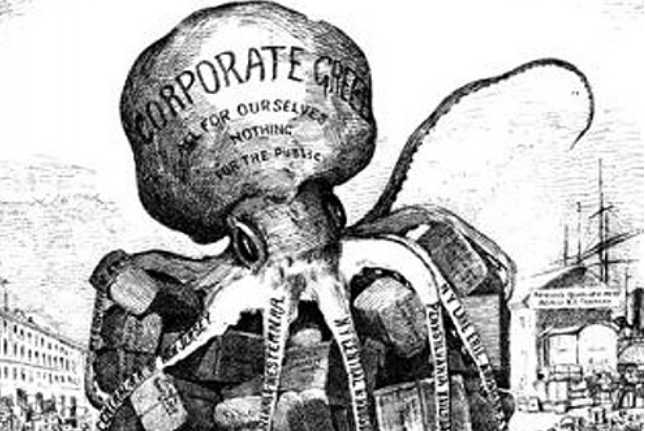

“Seniors and families already struggling to afford lifesaving medicines are told to brace for further price hikes by the same industry that saw its profits and shareholder rewards skyrocket by billions in a year,” Liz Zelnick, director of Accountable.US’ Economic Security and Corporate Power program, said in a statement Tuesday. “It only adds up to corporate greed.”

“Pharma executives’ claims that research and development expenses drive costs remain unconvincing,” Zelnick added, “when those costs are often eclipsed by billions of dollars in handouts to a small group of wealthy investors.”

The analysis comes as the pharmaceutical industry is suing the Biden administration over a 2022 law that gives Medicare the authority to negotiate the prices of a small number of high-cost medications directly with drugmakers.

Merck—which, according to Accountable.US, saw its profits rise to over $14.5 billion last year—launched the industry’s widely expected legal attack on the Inflation Reduction Act (IRA) provisions last month with a suit against the Health and Human Services Department.

Pharmaceutical Research and Manufacturers of America (PhRMA) joined the fight two weeks later. Bristol Myers Squibb, Astellas Pharma, Johnson & Johnson, and the U.S. Chamber of Commerce have also sued the Biden administration over the drug price negotiation provisions.

“The suits make similar and overlapping claims that the drug pricing provisions are unconstitutional,” The New York Timesreported Monday. “They are scattered in federal courts around the country—a tactic that experts say gives the industry a better chance of obtaining conflicting rulings that will put the legal challenges on a fast track to a business-friendly Supreme Court.”

Zelnick argued Tuesday that drug companies’ aggressive campaign against the drug price negotiations with Medicare “is all about preserving their industry’s corporate profiteering strategy, which has clearly been immune to repeated interest rate hikes from the Fed.”

Accountable.US’ analysis notes that “in the years leading up to the passage of the IRA,” PhRMA spent “nearly $70 million lobbying against efforts to allow Medicare to negotiate the prices of prescription drugs and other measures to lower drug prices.”

Common Dream’s work is licensed under a Creative Commons Attribution-Share Alike 3.0 License. Feel free to republish and share widely.

[content id=”79272″]