JUNEAU – The Alaska Senate Monday approved a modest increase to the state’s motor fuel tax rates.

JUNEAU – The Alaska Senate Monday approved a modest increase to the state’s motor fuel tax rates.

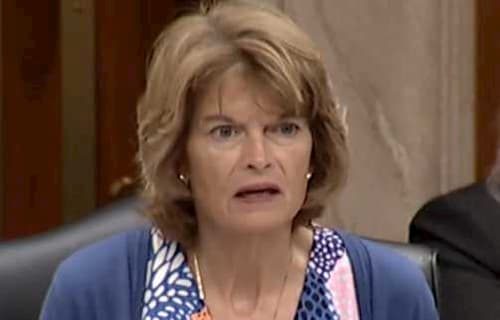

Senate Bill 115, sponsored by Senator Click Bishop, R-Fairbanks, increases the tax rates on highway and marine motor fuels to 16 cents and 10 cents per gallon, respectively, and is estimated to generate approximately $35 million in additional state revenue.

“This is a meaningful step toward funding the state’s backlog of transportation infrastructure and maintenance needs,” said Sen. Bishop. “A modest increase in transportation funding will improve public safety, stimulate economic growth and provide good-paying jobs for Alaskans.”

Alaska’s motor fuel tax rates have not changed for 50 years, since May 1970. With this increase, Alaska would still have the lowest marine fuel tax rate in the nation and the ninth lowest highway fuel tax rate.

Current law sets the per gallon base tax rates for highway fuel at 8 cents and marine fuel at 5 cents.

Alaska’s highway motor fuel tax rate of 8 cents per gallon was close to those of other states when it was enacted in 1970. Since that time, however, every other state has gradually increased motor fuel tax rates while Alaska has remained frozen in time. Alaska’s 1970 rate, adjusted for inflation, would be roughly 52 cents today, meaning the tax has lost about 85 percent of its purchasing power since 1970.

The bill does not propose increases to aviation or jet fuel tax rates because Alaska currently ranks competitively among the other states for these fuel types: 40th for aviation fuel and 36th for jet fuel.

SB 115 passed the Senate by a vote of 12-5 and is now on its way to the Alaska House of Representatives for consideration.

For more information, contact Senate Majority Communications Director Daniel McDonald at (907) 465-4066.

###

[content id=”79272″]