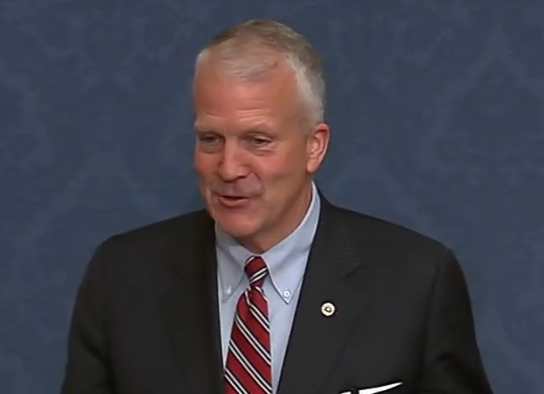

Maryland tax authorities said this week they’ll investigate whether Republican U.S. Senate candidate Dan Sullivan improperly benefitted from tax breaks intended for Maryland residents for a house he owned in the suburbs of Washington, D.C.

Maryland tax authorities said this week they’ll investigate whether Republican U.S. Senate candidate Dan Sullivan improperly benefitted from tax breaks intended for Maryland residents for a house he owned in the suburbs of Washington, D.C.

As it turns out, Sullivan’s history of voting in Alaska elections may cost him, even though it helps counter charges that he’s a newcomer.

Questions about the length of his residency in Alaska that have dogged him since the start of his campaign. Rival Republican Mead Treadwell said he had mayonnaise with longer tenure in his fridge. And months ago, the superPAC supporting Sen. Mark Begich, Put Alaska First, zeroed in on a house Sullivan bought in Bethesda, Maryland in 2006, when he worked for the State Department.

“Documents show that while Sullivan pocketed a Maryland tax credit for residents living there, he was voting in Alaska, claiming to be one of us,” one of their ads said.

The head of the Alaska Democratic Party wrote Maryland authorities last week to question whether Sullivan was eligible for that tax break, known as the Homestead exemption. Party Chair Mike Wenstrup insists the purpose of the letter is fact-finding, not to get Sullivan in trouble with tax collectors.

“If he’s saying ‘I’m a resident of Maryland’ to people in Maryland and also saying ‘I am a resident of Alaska’ to the people of Alaska, you know, he’s not being truthful,” Wenstrup says.

The director of the Maryland Department of Assessments and Taxation, Robert E. Young, said this week he hadn’t yet received the letter, but he will launch a review of the case.

“We have an obligation, a legal obligation, to investigate every claim that someone is improperly receiving a Homestead credit,” he said.

Maryland legislators passed a law in 2007 to crack down on abuses of the tax break. Young says he gets thousands of complaints a year, many from citizen watchdogs and some against members of Congress. Just last month, his office told Walt Havenstein, the Republican nominee for governor of New Hampshire, he must pay back $9,000 in Homestead credits he took for a condo he owned in Bethesda, starting in 2007, when he was working in the Beltway for defense contractors.

Democrats in New Hampshire are drawing attention to it. Wenstrup, the Alaska Democratic Party chair, says news of that case prompted him to request a review of Sullivan’s file.

A spokesman for the Sullivan campaign declined requests for an interview for this story. On his campaign website, Sullivan says he never applied for Maryland’s Homestead credit, which he says was automatically provided back then for owner-occupied homes.

Young, the Maryland taxman, says it wasn’t automatic but based on a document Sullivan and his wife signed in 2006, swearing the Bethesda house was their principal residence and they planned to live there most of the next year. The statement references a different tax break for residents, known as the recordation tax, but Young says it’s what his office and county authorities relied on to grant the Homestead credit. All told, their Bethesda residency claim saved the Sullivans some $5,000 over the two and a half years they lived there.

Young says he looks at a number of factors in deciding whether a homeowner is eligible for the Homestead credit. Physical presence is required, but Young says so is legal presence. If a person votes in another state, he says that’s evidence he can’t overlook.

“What’s my legal presence? And my legal presence is where I vote,” he said. “And as I say, voting is important.”

According to the state’s voter list, Sullivan voted by mail in Alaska’s general election in 2008, during the period he was claiming Maryland’s homestead credit.

Sullivan’s campaign website says he and his wife considered their time outside Alaska as a temporary duty assignment.