Worries about China’s faltering economic growth pushed down stock and oil prices around the world on Monday.

Worries about China’s faltering economic growth pushed down stock and oil prices around the world on Monday.

U.S. stock markets plunged at the open, with the Dow off nearly 5 percent in the first few minutes of trading. After a day of wild swings in stock prices, U.S. indexes were down 3.6 percent or more at the close of trading.

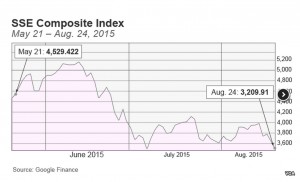

In Asia, Shanghai’s stock index plunged more than 8 percent, Japan’s main market lost more than 4 percent and Hong Kong was down more than 5 percent. Key European indexes were off 4 percent or more. India’s Sensex dropped 5 percent, its steepest drop in six years.

Prices for many commodities also declined, with the price of crude oil off by more than 4 percent to hit the lowest price in more than six years.

China’s growing economy has been a major market for commodities and all kinds of goods for many years.

A series of economic shocks, including a falling stock market and a surprise devaluation of the currency, have made investors question the health and growth of the world’s second-largest economy. An economy that grows slowly will need less energy and provide less opportunity for investors in many areas.

NYSE traders react to Monday’s markets:

White House spokesman Josh Earnest said Monday that President Obama is confident in the strength and resilience of the U.S. economy. He urged China to move toward reforms, including a market-determined exchange rate system and more transparent economy.

Some investors were disappointed that China’s government had not taken fresh steps to ease the stock market losses.

Volatility could continue

Analysts warn the market volatility is set to continue in the days ahead, with trillions of dollars already wiped off global share markets since China reduced the value of its currency, the yuan.

The Wall Street Journal reports investors are disappointed that China’s government had not taken fresh steps to ease the stock market losses.

7 days of losses in Asia-Pacific

Monday marked the seventh straight day of losses on key Asia-Pacific market indices, down almost 5 percent, the most since 2011.

“I guess the question that people are starting to ask – and certainly I’m asking is how, just how this gets stemmed,” said Sydney-based senior foreign exchange strategist for ANZ Bank, Daniel Bean.

Singapore-based Daniel Martin, senior Asia economist for research firm Capital Markets, says China’s economy is more stable than many investors realize.

“The equity market side; if it is a reflection of China’s economy doing a lot worse than we have previously thought, then that’s obviously a big issue for Asian economies. We don’t actually think that’s the case though. We see it more as a stock market correction that will run its course and should settle down within the next few weeks or so,” he said, adding “I don’t think they’re panicking that the economy is suddenly falling off a cliff, which markets seem to be thinking it is.”

Asian market analysts say the U.S. Federal Reserve may wait until next year to raise U.S. interest rates, given the uncertain market climate.

Source :VOA

[content id=”18651″]