ANCHORAGE-Governor Bill Walker Friday issued a proclamation convening the 30th Alaska State Legislature on October 23 in Juneau for its fourth special session to address public safety and revenue. On the call are Senate Bill 54, which addresses Class-C felonies, and a bill to enact a flat wage tax.

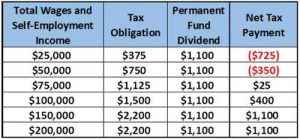

The administration is proposing a payroll tax of 1.5 percent of wages earned by Alaskans and non-resident workers, capped at $2,200 or twice the previous year’s permanent fund dividend amount-whichever is higher. For example, a person who earned $50,000 would pay $750 in payroll tax and receive a PFD.

The proposal is expected to generate between $300 million and $325 million-about 15 percent of which is projected to come from non-resident workers, who in 2015 earned more than $2.7 billion. Under this proposal, Alaskans would pay the lowest taxes on a nationwide basis. No other state currently has a cap for a maximum tax rate.

“My team and I have been meeting with majority and minority members of both the House and Senate for the past several months,” Governor Walker said. “We have cut more than 44 percent from state spending over the past four years, and drawn more than $14 billion from savings. We will continue to find efficiencies. With the downturn in oil prices, however, it’s clear that we must find a new source of revenue to pay for troopers, teachers, transportation and other essential services. We must end the uncertainty for a healthy economy.”

Since 2014, the Walker-Mallott administration and the legislature have cut state spending by $1.7 billion, 29 percent.

09.22.17 Proclamation 4th Special Session

House Bill Packet: Payroll Tax Legislation, Transmittal Letter, & Fiscal Note

Senate Bill Packet: Payroll Tax Legislation, Transmittal Letter, & Fiscal Note

Source: State of Alaska[xyz-ihs snippet=”Adsense-responsive”]