Anchorage, AK – Tuesday, S&P Global Ratings downgraded the Municipality general obligation (GO) and certificate of participation (COPS) bonds from a “AAA” rating to a “AA+” rating. S&P also lowered its outlook on all GO bond ratings for the Municipality of Anchorage from “stable” to “negative”. The downgrades reflect a material decline in the municipality’s available reserves, which is expected to worsen in Fiscal Year 2021. S&P Global Ratings states that “If the municipality is unable to restore reserves to their fund balance targets in 2022 and 2023, we could lower the rating.”

S&P Global Ratings view of the municipality’s general creditworthiness is due to appropriation risk.

S&P Global Ratings states “Capital expenditures from the 2018 earthquake, revenue declines from COVID-19, and the cost and labor shortages associated with construction in Alaska, and delayed Federal Emergency Management Agency (FEMA) reimbursements have forced the municipality to draw down its reserves. Officials hope to increase fund balances in 2022 and 2023, but they face numerous challenges to restore reserves.”

Fitch Ratings also Tuesday assigned a ‘AA+’ rating to the Municipality of Anchorage’s general obligation bonds. The stable outlook comes with a warning based on expenditures that have been incurred beyond the federal assistance during the pandemic.

These additional costs resulted in a negative $40 million year end 2020 fund balance for the Municipality as a whole.

The Fitch Ratings report states “Additional upfront costs to address the disasters were incurred in fiscal year 2021, which will diminish the municipality’s financial cushion and heighten fiscal risk. Fitch expects the municipality to take all necessary steps for FEMA reimbursements, but delays or inability to be reimbursed could prolong a diminished financial cushion and could result in negative pressure on the rating.”

A downgrade in the rating of the Municipality’s General Obligation Bonds would trigger a material increase in interest expense costs associated with borrowing in the Capital Marketplace.

This could make it more expensive for the Municipality of Anchorage to borrow in the future with the increased costs directly impacting taxpayers.[content id=”79272″]

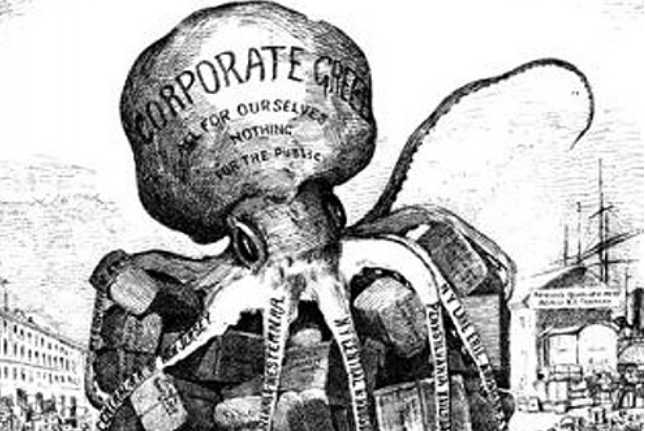

From 2016 to 2020, government spending has increased in the MOA by approximately 20%. The MOA Unassigned Fund Balance went from a surplus of $11.2 million in 2016 to a total deficit of ($40) million in 2020. During the same period the Municipality of Anchorage’s population has decreased from 299,330 to 285,400 residents.

“I believe that government should begin right-sizing unsustainable spending to reflect the decreases in population that have occurred in the MOA over the past several years,” said Mayor Dave Bronson. “Now is the time to act, to eliminate the level of uncertainty Anchorage residents and taxpayers have felt for years. That’s why this proposed budget is a call to action for us. I will continue to seek a decrease in government spending and seek to take the burden off the tax cap for all people of Anchorage. We don’t want our children and grandchildren to have to pay the debts incurred today.”

S&P Global Ratings report states that the Municipality of Anchorage can return to a stable scenario if it restores reserves through a combination of FEMA reimbursements or reducing expenditures, and they could revise the outlook to stable.

The Fitch Ratings report states that budget management in times of economic recovery historically has been strong, with prompt rebuilding of the municipality’s reserve safety margin. And that sound budgeting practices include things like “frequent course corrections to restore long-term structural budget balance.”

###[content id=”79272″]