The global oil benchmark, Brent crude, fell Thursday to about $79.8 per barrel before rebounding to finish the day at around $82.7 per barrel, the lowest price since mid-2012. The latest sell-off follows one of the sharpest declines in a quarter in recent years, in which the price of oil slid about 16 percent. It may be premature to forecast sustained international oil prices lower than $90 per barrel, but if the price of oil remains close to where it is now, many oil exporting countries will feel the pain after basing their budgets on previous price expectations.

The global oil benchmark, Brent crude, fell Thursday to about $79.8 per barrel before rebounding to finish the day at around $82.7 per barrel, the lowest price since mid-2012. The latest sell-off follows one of the sharpest declines in a quarter in recent years, in which the price of oil slid about 16 percent. It may be premature to forecast sustained international oil prices lower than $90 per barrel, but if the price of oil remains close to where it is now, many oil exporting countries will feel the pain after basing their budgets on previous price expectations.

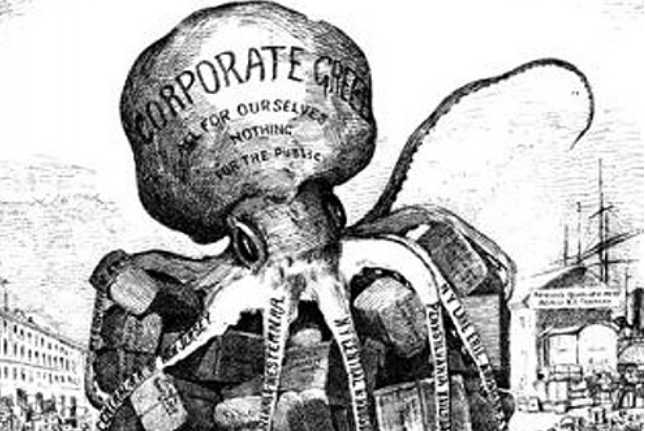

Simply put, the oil market has gotten overstocked. After spending much of the year producing only around 200,000 barrels per day, Libya has seen its production jump up by about 700,000 bpd since mid-June. The United States has continued its relentless expansion of oil production, with the latest Energy Information Agency figures estimating that U.S. production has increased by about 300,000 bpd since the beginning of August, and Iraq has experienced similar gains. Russia, Angola and Nigeria have also seen marked boosts in production. While most of the recent production increases are one-offs, North America could add another 1 million to 1.5 million barrels of production by the end of next year.

Despite these noteworthy hikes in oil production, sluggish demand by European and Asian (particularly Chinese) consumers has proved just as important to oil prices. While China’s demand will continue to grow, demand in developed countries will remain flat, as it has for a while. These factors only add to the concern that if left unchecked, oil prices per barrel in the $90-$100 range may persist for the foreseeable future.

Lower global oil prices will create challenges for several OPEC producers and others, particularly Russia. While some have suggested that OPEC will lower its production targets, it may not have the ability or the unity to coordinate a large enough drop in production to counter trends elsewhere and bring prices to a level more desirable to it (above $100 per barrel). If oil prices do return to this level in the near future, it likely will have little to do with OPEC’s actions.

The Standoff Between Russia and the West

The first and most import consequence of lower oil prices is the effect it will have on the ongoing struggle between Russia and the West. Energy commodities dominate the Russian economy, particularly its exports. Any sustained drop in oil prices would directly impact the country’s export revenues, and Russia’s GDP would take a significant hit. The Kremlin’s 2014 budget was based on oil prices averaging $117 per barrel for most of the year, with the exception of prices of $90 per barrel for the fourth quarter. For 2015, however, the budget has been pegged at $100 per barrel after much debate within the Russian leadership. While Moscow has significant financial reserves and can run a budget deficit if need be, Finance Ministry officials have estimated that lower oil prices could shave off 2 percent of Russia’s GDP.

Although Russia has been able to weather the effects of U.S. and EU sanctions thus far for its action in Ukraine, the restrictions have already led some firms, such as Rosneft, to ask for financial assistance from the country’s National Wealth Fund. A reduction in oil prices, and in turn lower revenues for Russia’s budget, will constrain the Kremlin’s ability to support Russian businesses hurt by sanctions the longer they are in place. With less of a financial cushion to soften to consequences of sanctions in the longer term, the Kremlin will have to moderate its position in the ongoing negotiations over the future of Ukraine to meet the demands of Western partners and achieve a reduction in sanctions.

Competition in the Middle East

As the West looks to gain from low oil prices in its struggle with Russia, it is also looking for an opportunity to negotiate with a beleaguered Tehran to come to some sort of a resolution on the Iranian nuclear program. For Europe, Iran and its large natural gas reserves represent one of the most promising long-term sustainable alternatives to Russian natural gas. Tehran is facing sanctioned export volumes, lower profit margins and ongoing expenses because of proxy conflicts in Syria and Iraq, and it can ill afford a sustained downturn in global oil prices. Progress on coming to an agreement with the West may be slow, which will only place more pressure on Tehran to negotiate.

Saudi Arabia is also set on maintaining its global market share and has an opportunity in the short term to rely on its considerable foreign exchange reserves and low production costs to wait out other global producers. Riyadh’s oil output is its most strategic resource, and one that the government is quick to use to its advantage. With summer temperatures beginning to cool and regional consumption starting to taper off, Riyadh can free up larger volumes to export, even at lower prices. The Saudis are also looking to leverage their short-term economic stability over rivals such as Russia, especially as they square off with Iran over the future of the Syrian government.

Saudi Arabia also has the ability to take a considerable number of barrels of oil offline if it wants to. Recently, however, it has offered discounts on its crude oil to secure market share for November, perhaps signaling to other OPEC members that while Riyadh may be willing to take its supply offline, others will have to do the same. But there is no incentive for other countries to reduce their output, since most Gulf producers will still manage to make a profit in the $90-$100 per barrel range; lowering production levels, therefore, would only reduce revenues.

The Americas and Beyond

Outside the Middle East, a decline in oil prices will also affect Venezuela. Officially, Caracas sets its budget at the low target of $60 per barrel of oil, a precedent begun by former President Hugo Chavez. Excess revenue could then be funneled elsewhere to off-budget expenditures to satisfy political patrons. Venezuela is in a dire financial position, needing oil prices perhaps as high as $110 to meet expenditures both on and off the book. Sustained low oil prices would severely hamper Caracas’ ability to finance its imports, perhaps forcing government officials to get serious on selling foreign assets, such as Citgo, and gold from its central bank reserves, or offering even more attractive terms on loans for oil deals with the Chinese, though Beijing has recently balked at this. If oil prices stay low for an extended period, Caracas could also be forced to reconsider its deals with Cuba or programs like Petrocaribe.

Meanwhile, for developed massive oil importers — Japan, China, India and the European Union — low oil prices will give some respite to significant import bills. On the other hand, prices could also increase short-term strain in Europe, where energy has been the main factor pushing monthly inflation lower. While lower energy costs are good for Europe in the long run, they also raise the threat of deflation and inflame tension between the European Central Bank and Germany.

Even though prices have likely bottomed out, the recent plunge in the price of oil serves as a reminder of how geopolitically significant energy prices can be. Energy supplies form the backbone of modern industrial economies, and energy resources are critical export commodities for those who possess a lot of them. As long as fossil fuels remain the dominant source of energy — something that is likely to last at least another few decades — oil supply and oil prices will remain critical.

“Oil Prices Continue to Define Geopolitics is republished with permission of Stratfor.”

![OP/ED:State Invents New Numbers On $ Loss From New Oil Tax Law [signed] Les Gara](https://www.akdemocrats.org/images/signatures/5.jpg)