I’m sorry for not bugging you with one of these newsletters in a while – work has been crazy, and I’ve been battling to fix what I think is the worst piece of legislation this state has seen in a long time – an oil tax bill that will create a fiscal cliff, cause $2 billion per year in annual deficits, and result in a loss of jobs through ripple effects across the state.

The bill, at $120 a barrel, gives away roughly $1.5 – $2 billion in state revenue per year.

|

|

YOU CAN TESTIFY ON THIS BILL Tuesday April 9 by going to the Legislative Information Office (LIO) at 716 W. 4th Avenue, suite 200, if you’re in Anchorage. Testimony is limited to two minutes per person. The hearing begins at 5pm and you must sign in by 8pm in order to testify. If you need help finding an LIO, call us at 465-2647.

Oh – and the biggest part of that giveaway goes to Exxon, BP and Conoco, and DOESN’T require them to invest that money in Alaska. That part is the deletion of our windfall profits share – which rationally says that after a company makes $30 of profit on a barrel of oil, our modest 25% tax rate rises slowly so you can share in the windfall profits that earn companies record and near record profits. Conoco, for example, has earned roughly $2 billion per year in Alaska under the current system because of high prices, and we have shared in that bounty. We should.

As you may know, I have pushed a bill that only grants tax relief if companies invest in Alaska production, or Alaska research that leads to new heavy oil production. Here is a link to that proposal.

I’ve fought to reverse what is looking like a fourth year in a row of school staffing cuts. I want a strong university, construction jobs, law enforcement jobs, and strong future for this state. Giving away money on a hope, wing, and prayer that companies will reinvest it here isn’t good policy. Creating annual $1 – $2 billion deficits isn’t good policy. Smart tax breaks that are linked to investment in Alaska and that require the production and investment in new oil do make sense.

Oh, and the Governor has reduced our tax rate to a paltry 17% (approx.) according to his officials after I pressed them yesterday. That’s for “new oil” found in the highly profitable legacy fields like Prudhoe Bay and Kuparuk, and new oil in new fields. Forever. When this state is running on only “new oil” we would be able to sustain an economy on a 17% tax rate. I have proposed a seven-year tax break on new oil, and at a fairer tax rate. A forever giveaway isn’t in your interests or mine.

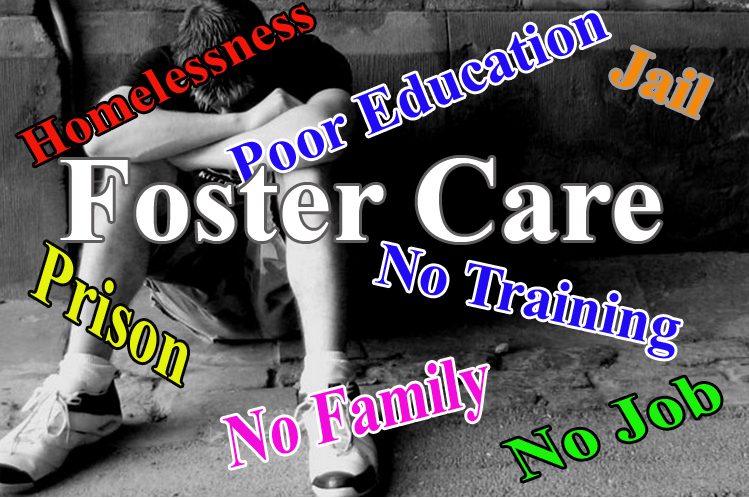

Foster Care and Affordable Housing/Smart Community Planning Bills Moving

Two of our bills have been on the move. One aims to make sure the state does a better job looking for family members who are fit to be good foster parents when a child is taken away from their parents. It passed one committee a few weeks ago and is in the House Judiciary Committee today. That bill is HB 54.

Also, Rep. Mia Costello and I are pushing HB 50, which will make Alaska more vibrant and housing more affordable. The bill removes a ban on commercial and non-profit space in AHFC or AHFC-financed housing. We think it’s good to have a restaurant, drug store, grocery store, coffee shop, day care center or other amenities in large housing complexes. It makes communities more vibrant (local zoning laws would apply). Also, the testimony has been that by allowing full cost commercial tenants, AHFC will be able to add additional housing units to help meet the middle and low income housing shortage in Alaska. And, to AHFC’s credit, they are financing a lot of mixed income housing, which studies say works better for all than low-income residential-housing only, where only people from the same economic background are clustered together.

KABATA – The Expensive Bridge To Somewhere

Four years ago the state agency responsible for finding a private company to build this bridge promised they could do that without any state funding. They said the tolls would cover the cost of construction, maintenance and the profits needed by the private developer. Then last year they said tolls would not cover the cost, and that we should give the private developer $150 million to cover their profits, costs of construction and costs of maintenance.

Oh, and we’ll have to build a tunnel through Government Hill and a highway from Government Hill to the start of the bridge on the Anchorage side, and a second bridge and highway to get to the bridge in a few years to deal with Anchorage traffic. And a bunch of roads on the Mat-Su side because right now the landing point on that side ends far away from any needed highway infrastructure.

So what happened to the “this will be free” and the “this will only require $150 million in state money” arguments? Well, this year they said they might be $1.14 billion short, because not that many people will really use the bridge, and need that money to subsidize the private company’s profits, costs of construction and costs of operation. They wanted a guarantee from the state that in times of declining revenue, and school cuts, that we’d cover up to $1.14 billion in shortfalls.

That’s not the end of it. Many of us knew they were basing even that projection on inflated bridge use and toll estimates. The bridge, all admit, wont shorten the commute to either the Wasilla or Palmer areas. Those people will drive for free on the Glenn highway. This weekend an audit came out saying we were right. That they far overstated the projections of who would use the bridge to Point McKenzie. So, now we don’t know how much will be needed from the state to subsidize this “private” project. $2 billion? $3 billion with expected cost overruns? All we know is that the folks promoting this bridge used a traffic consultant that has been cited for overestimating traffic use by over 100% on average, to make it look like the bridge would generate more toll revenue to pay for itself, than it actually will.

There is likely to be a vote on this bill this week.

OK, I have to run back to the Finance Committee. As always, call with any questions or concerns.

My Best,

![OP/ED:State Invents New Numbers On $ Loss From New Oil Tax Law [signed] Les Gara](https://www.akdemocrats.org/images/signatures/5.jpg)