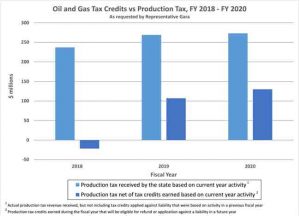

JUNEAU – This week, economists with the Alaska Department of Revenue produced a report analyzing how much Alaska generates in oil production taxes after the state pays out subsidies in the form of oil tax credits. The report shows that in the next fiscal year, FY 2018, the state of Alaska is slated to pay out roughly $20 million more in tax credits than it is estimated to receive in production tax payments.

“Former Alaska Governor Jay Hammond always stressed to me that a fair share for our oil is constitutionally mandated,” said Representative Les Gara, who asked for the Revenue Department report. “Governor Hammond wanted the state of Alaska to be partners with the oil industry, not junior partners. I agree with former Governor Hammond that we should protect the people of Alaska as strongly as oil companies protect their shareholder’s interests in profits.”

Rep. Gara is the sponsor of House Bill 133, which seeks a raise in oil production taxes at prices when companies are profitable. The bill would generate $50 million in additional revenue in FY 2018 and $190 million in FY 2019 at projected prices. HB 111, which primarily seeks to revise Alaska’s unaffordable oil industry subsidies, is currently under consideration by the House Resources Committee.

“We need to do better for Alaskans than an oil tax that produces negative, or almost no revenue,” said Rep. Gara. “Alaskans deserve a tax regime that produces the constitutionally mandated fair share for our publically owned oil resources.”[xyz-ihs snippet=”Adsense-responsive”]The Department of Revenue report shows that oil production taxes, once the mainstay of Alaska’s oil revenue system, will generate around $20 million less in FY 2018 than the tax credit subsidies owed to the oil industry. That’s effectively a loss of $20 million for the state under the current oil tax system.

As prices are projected to increase in 2019 and 2020, the revenue projections don’t improve dramatically. Before 2015, the state of Alaska historically generated $5 billion and more from oil production taxes. However, low tax rates and high subsidy payments will result in a net of just $100 million to $150 million in production taxes in 2019 and 2020.

“That’s less than five percent of what’s needed to cover our public school budget. It would only cover about a fifth of the budget for the University of Alaska,” said Rep. Gara. “Alaska’s oil wealth should be used to fund essential state services like plowed roads, great schools, and help for the most vulnerable among us. It’s time we stand up and demand a good deal for our shareholders, the people of Alaska. Reform to our subsidy and production tax system is needed and overdue.”[xyz-ihs snippet=”Adsense-responsive”]

![OP/ED:State Invents New Numbers On $ Loss From New Oil Tax Law [signed] Les Gara](https://www.akdemocrats.org/images/signatures/5.jpg)