The race is on. To avoid looking like a fool, Parnell needs his tax cuts hammered into law before Great Bear’s anticipated production enters the pipeline. If he does, he will look like the rooster that made the sunrise; if he fails he will look like the Emperor with no clothes.

The newly perfected “fracking technology” fueling the oil boom in North Dakota, Pennsylvania, and Texas is now booming on the North Slope thanks to Great Bear Petroleum. “Fracking technology” will likely soon be filling Alaska’s pipeline with or without Parnell’s tax cuts.

A few months back, without any mention of need for tax cuts, Great Bear’s President Ed Duncan told a committee of the Alaska State Senate that, if their test wells work as anticipated, Great Bear expects to drill about 200 “fracking wells” the following year. At the July 31stseminar, Duncan went on to say that thus far he is “very happy” with test well results.

|

|

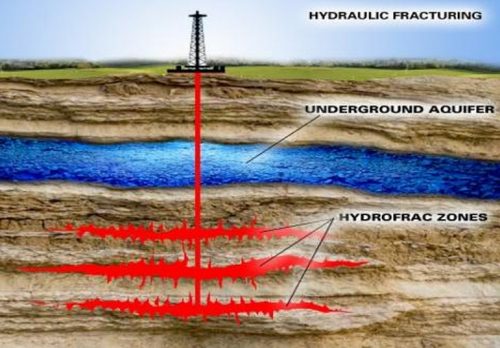

Duncan explained that fracking wells are drilled into brittle rocks containing billions of tiny deposits of oil that are released when the rocks are fractured by hydraulic pressure from water and sand they pump into the rock. He explained that fracking wells tend to start off producing between one and two thousand barrels per day and fall off rapidly in their second and third years of production. He explained that the key to continued production in a fracturing operation is a labor intensive continuation of drilling new wells to replace rapidly declining previous wells.

A possible scenario: two hundred wells averaging 1,500 BPD (barrels per day) in year one, totaling 300,000 BPD, followed by 200,000 BPD from the same wells in year two, and 100,000 in year three. But each year, Great Bear plans another two hundred wells to replace the declining wells. Their second year of operation might include two hundred wells that have fallen off to 200,000 BPD, plus two hundred new wells producing 300,000 BPD, totaling 500,000 BPD. In year three, two hundred wells producing 100,000 BPD, two hundred wells producing 200,000 BPD, and two hundred new wells producing 300,000 BPD for a total production of 600,000 BPD.

It was Duncan who provided the 1,500 BPD starting well production information, the rapid decline information, and the production well replacement information at the conference. Earlier, Duncan told a senate committee of plans to drill 200 wells in the year following well tests if well tests prove favorable. The two snippets of information combined support the 600,000 BPD scenario above. When Duncan was asked at the conference what he anticipated for production in five years, he gave conflicting answers. His direct answer was at minimum 100,000 BPD, and probably more. However he also made reference to Texas ramping fracking well production up from 3,000 BPD to 500,000 BPD in three years and said there was no reason that couldn’t happen in Alaska. That evening, KTVA television news reported Great Bear as having told them that production could soon be as much as 700,000 BPD.

|

|

Comparatively, Prudhoe’s producers simply stick a few oversized straws into a few sweet spots and let them flow. Great Bear’s task is far more labor intensive. However, at no time has Great Bear hinted needing a tax cut to be profitable. Only two people at the conference were pushing tax cuts; Parnell’s Deputy Commissioner Joe Balash, and Homer Republican Representative Paul Seaton. Balash said the North Slope was booming. Then he said the pipeline would run dry without tax cuts; go figure. Seaton, seemingly intends to shove Parnell’s tax cut down Great Bear’s throat whether they ask for it or not.

Great Bear’s production plus existing production could soon meet Parnell’s definition of a filled pipeline. If it happens before Parnell succeeds in redirecting Alaska’s dividends to his past employer his tax cut will be dead. If Parnell’s tax cuts pass, Great Bear or not, Alaska’s oil revenues will fall off so sharply you can probably kiss your PFD goodbye.

Ray Metcalfe 8/03/2012, Anchorage Alaska