V. AK LNG

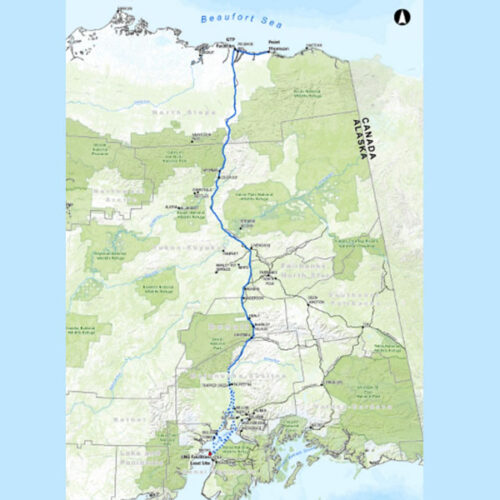

Now, to the ultimate dream for our state, the gas line and the AK LNG project. My team and I are working on advancing this project daily.

I’ve traveled four times to Japan and Korea in the last few years, promoting Alaskan gas. I’ve hosted dozens of meetings with energy companies, financiers, of course, our own federal government officials, Asian LNG importers, Asian government leaders. Just in the past few weeks, I’ve had discussions with the President, his chief of staff, several members of his cabinet. They are aggressively continuing to make AK LNG a project that is a top priority of theirs.

If you look again at that executive order from Day One, AK LNG is highlighted as a top priority for the Trump administration.

The Working Families Tax Cuts Act also created a Department of Energy financing facility designed to support major energy infrastructure projects for America. We are relentlessly trying to unleash such Department of Energy financing for this project.

Last year, I spoke about how we have continued, my team and I, ramming against the AK LNG line. Sometimes it seems like a fool’s errand. Other times not. I said then, “A crack has developed, an 800-mile crack in this wall, that shows undeniable progress.” That crack is now taking the shape of a doorway. Maybe that door never opens for our state, but the undeniable progress continues.

Now, I know there’s a small but loud cohort of people in Alaska who consistently say, “This project is impossible. It can never happen.”

I certainly hope these naysayers are not right. This may be our last, best chance to achieve our Alaska LNG dream. Here’s my ask of all of you: Join me in doing everything in your power to make this dream a reality. Think creatively, be bold.

I’ll give you an example of something we’ve been pressing on, and we just made really important progress yesterday on: new federal data centers on Air Force bases in Alaska for AI computing.

This will help our military. It will help increase domestic demand for our gas and lower the costs of building and financing the pipeline. And, just yesterday, the Air Force, at my strong urging, put out a request for information on doing this in Alaska for data centers.

This is a big idea. We have a handout on this one, too. I’ve been pitching this to everybody in the country who will listen. But yesterday, the Air Force said we’re going to start that process in Alaska. I think that’s a very important step.

You all know this, but imagine the possibilities. What we could achieve with a nearly inexhaustible supply of our own affordable, clean energy for the whole state. Imagine the private sector opportunities that could start here—manufacturing, thousands of good-paying jobs, data centers, a steady source of income for many years to fill our state’s coffers.

It is too big, too transformative, in terms of the possibilities for our great state, not to try at this moment with everything we all have collectively.

VI. Taxes and Child Care Comeback

And, with the Working Families Tax Cuts Act, we now have a tax system that can help spur the renaissance of businesses and good-paying jobs that can come with the North Slope oil boom, that can come with the gas line.

Alaskans know that buying equipment is one of the biggest costs when starting or expanding a business. This bill that we passed in July allows businesses to write off these costs in the first year. For our small business owners here, you know how important that is–including for equipment and research and development. This helps our small businesses keep more cash, invest more, and very importantly, create more jobs for Alaskans.

For businesses and families, this bill prevented the largest tax increase in American history. It would have been $4 trillion, over $4 trillion, had we not acted last year and replaced that with permanent tax relief.

For Alaska families, this means an estimated annual tax savings anywhere from $7,500 to almost $11,000 for a family of four. And, for Alaskans on Social Security, this bill creates a $12,000 deduction per couple, providing real relief for our seniors who are living on fixed incomes.

We also eliminated taxes on tips and overtime, making it easier for Alaskans, working Alaskans, to keep more of what they’ve earned. That’s a good one.

And another area where this bill delivers is child care. I want to thank Alyse Galvin, who has brought this issue to my attention, like so many other Alaskans, for years.

This bill modernizes long outdated policies by strengthening the child tax credit, expanding dependent care assistance, and dramatically, historically, increasing tax credits for businesses to invest in their own child care facilities, and pool resources, with other businesses to do so. Thank you, Alyse. We made big progress on this bill.