It was announced on Thursday by U.S. District Attorney Karen L. Loeffler, that Puyallup, Washington man, 55-year-old Floyd Jay Mann, has been arrested and charged with 11 counts of wire fraud and eight counts of money laundering for bilking Alaskans out of money.

It was announced on Thursday by U.S. District Attorney Karen L. Loeffler, that Puyallup, Washington man, 55-year-old Floyd Jay Mann, has been arrested and charged with 11 counts of wire fraud and eight counts of money laundering for bilking Alaskans out of money.

According to this morning’s release by the Justice Department, along with F.Mann’s 19-count federal indictment, his wife Cheryl Mann was also indicted on one count of Social Security fraud for wrongfully collecting $56,000 in needs-based Supplemental Security Income when she was not eligible for benefits.

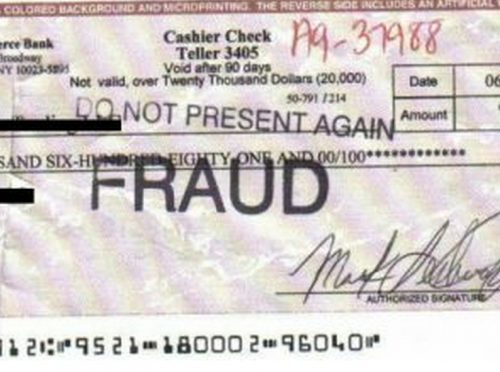

F. Mann collected $2,7 million from his Alaskan victims, leading them to believe that he was to be a recipient of a multi-million dollar settlement in a class action lawsuit a pharmaceutical company. He told his victims that if they helped pay for his medical bills and the cost of his lawsuit, they would be paid back, plus receive an additional substantial return for their money when the court released the funds.

In truth, there was no lawsuit settlement. Instead, F.Mann would take his victim’s funds and gamble at a casino, where during the course of his scheme, he would win over a million dollars gambling.[xyz-ihs snippet=”adsense-body-ad”]According to Special Assistant U.S. Attorney Benjamin Diggs, who presented the case against Cheryl Mann in Seattle, F. Mann, his wife, and son “collected approximately $56,000 in need-based Supplemental Security Income benefits. Cheryl Mann was the designated payee for Floyd Mann and their son and responsible for reporting any changes in the household income or assets. During this time, Cheryl Mann won approximately $125,000 at a casino. That income, as well as the funds obtained by her

husband, would have disqualified the Manns from the public assistance they received.”

If cnvicted of his crimes, F. Mann faces a maximum sentence of 20 years in prison and a $250,000 fine.

C.Mann faces a maximum sentence of five years in federal prison and a fine of $250,000.

“Fraud comes in all shapes and sizes, but this particular fraud is rather peculiar. The accused not only bilked millions of dollars from Alaskans in a well-concocted scheme, they further squandered the ill-gotten gains on gambling all while collecting Social Security benefits for which they no longer qualified. Unfortunately for the defendants, IRS CI Special Agents are expertly and uniquely skilled to follow the money in these and other types of financial crimes,” stated Special Agent in Charge Darrell Waldon of IRC Criminal Investigation.

The investigation that led to the indictments was carried out by IRS Criminal Investigations, the FBI, and the Social Security Office of the Inspector General.[xyz-ihs snippet=”Adversal-468×60″]