Billionaires have seen their wealth skyrocket over the past two years, adding roughly $2.7 billion per day to their fortunes while ordinary people struggle to afford basic necessities.

As the world’s corporate and political elite convened in Davos, Switzerland for the first winter World Economic Forum in three years, an analysis published Monday by Oxfam International found that the global rich have captured nearly two-thirds of all wealth generated since 2020—a period marked by a devastating pandemic, worsening costs of living crises, and continued fallout from the climate emergency.

In a new report titled Survival of the Richest, Oxfam shows that the top 1% worldwide grabbed $26 trillion of the $42 trillion in new wealth created, close to twice as much as the bottom 99% of the global population.

Billionaires, in particular, have seen their wealth explode since 2020, adding around $1.7 million to their net worth for every $1 in wealth gained by a person in the bottom 90% of the global income distribution. According to Oxfam, billionaires’ fortunes have grown by an average of $2.7 billion per day since 2020.

Meanwhile, nearly 2 billion workers across the globe likely saw inflation rise at a faster pace than their wages, resulting in a real pay cut that has increased poverty, hunger, and other hardships.

“While ordinary people are making daily sacrifices on essentials like food, the super-rich have outdone even their wildest dreams,” said Gabriela Bucher, executive director of Oxfam International. “Just two years in, this decade is shaping up to be the best yet for billionaires—a roaring ‘20s boom for the world’s richest.”

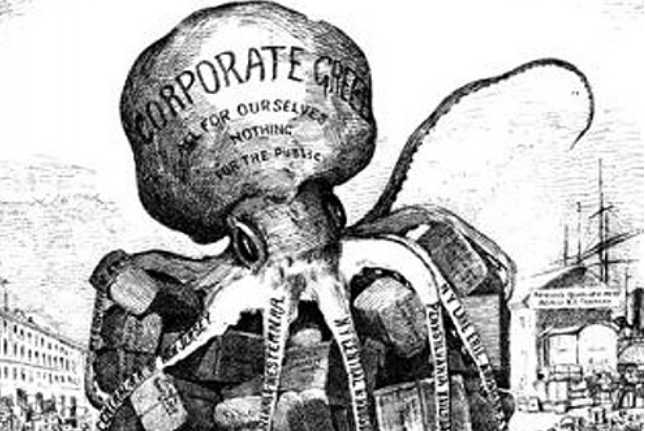

Oxfam’s report also spotlights how corporations have taken advantage of crises such as pandemic-induced supply chain woes and Russia’s war on Ukraine to drive up prices for consumers around the world, making it more difficult for billions of people to afford basic necessities.

The analysis finds that at least 95 food and energy corporations more than doubled their profits in 2022, bringing in $306 billion in windfall profits and dishing out 84% of it to their shareholders.

“The Walton dynasty, which owns half of Walmart, received $8.5 billion over the last year,” Oxfam notes. “Indian billionaire Gautam Adani, owner of major energy corporations, has seen this wealth soar by $42 billion (46%) in 2022 alone. Excess corporate profits have driven at least half of inflation in Australia, the U.S., and the U.K.”

“Forty years of tax cuts for the super-rich have shown that a rising tide doesn’t lift all ships—just the superyachts.”

To combat skyrocketing inequality produced by excess corporate profits and the disproportionate wealth gains of the ultra-rich—who also contribute far more to the climate crisis than the rest of humanity—Oxfam argues that governments around the world should institute “a systemic and wide-ranging increase in taxation” targeting billionaires who often pay astonishingly low tax rates.

The new report cites the example of Tesla CEO Elon Musk, who—according to Internal Revenue Service documents obtained by ProPublica—paid a true tax rate of just over 3% between 2014 and 2018.

By comparison, Oxfam observes, “Aber Christine, a flour vendor in Uganda, makes $80 a month and pays a tax rate of 40%.”

The aid group’s report makes clear that Musk is hardly alone among billionaires in reaping massive wealth gains—much of it unrealized stock appreciation—while paying little tax.

“Every billionaire is a policy failure,” the report says. “The very existence of booming billionaires and record profits, while most people face austerity, rising poverty, and a cost-of-living crisis, is evidence of an economic system that fails to deliver for humanity. For too long, governments, international financial institutions, and elites have misled the world with a fictional story about trickle-down economics, in which low tax and high gains for a few would ultimately benefit us all. It is a story without any basis in truth.”

It’s unclear whether the Davos summit—dominated by individuals and corporations committed to preserving and growing their wealth—will feature discussion of anything close to the tax policy that Oxfam recommends. Specifically, the group calls on policymakers to “permanently increase taxes on the richest 1%… to a minimum of 60% of their income from both labor and capital, with higher rates for multi-millionaires and billionaires.”

Oxfam also urges governments to “tax the wealth of the richest 1% at rates high enough to significantly reduce the numbers and wealth of the richest people, and redistribute these resources. This includes implementing inheritance, property, and land taxes, as well as net wealth taxes.”

Taxation is not mentioned in an overview of the World Economic Forum’s central topics.

In a statement, Bucher said that “taxing the super-rich and big corporations is the door out of today’s overlapping crises.”

“It’s time we demolish the convenient myth that tax cuts for the richest result in their wealth somehow ‘trickling down’ to everyone else,” said Bucher. “Forty years of tax cuts for the super-rich have shown that a rising tide doesn’t lift all ships—just the superyachts.”[content id=”79272”]