On Thursday, a grand jury in Anchorage, returned and 90-count indictment on 11 defendants.

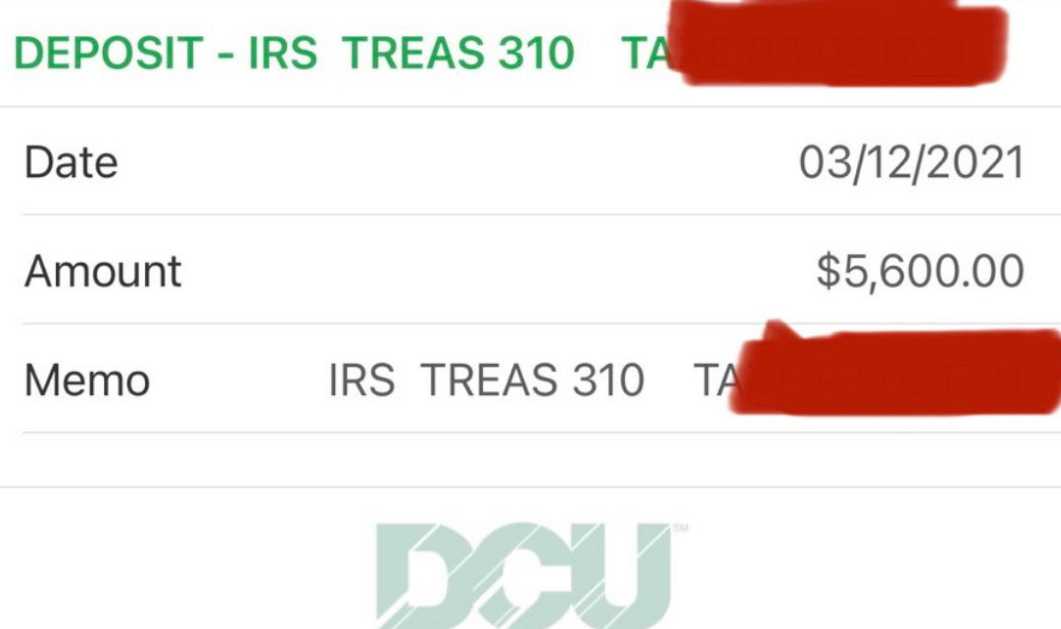

The indictment included a conspiracy charge to defraud the United States involving a scheme to use stolen Puerto Rican identities to file tax returns and obtain fraudulent income tax refunds.

According to the charges, the conspirators fabricated individual income tax returns, using stolen personal identification information from residents of the Commonwealth of Puerto Rico as well as residents of the state of Alaska. To do this, the defendants obtained laptop computers that contained over 2600 stolen identities.

The laptops identified $19 million in fraudulent refund claims. Information,such as addresses, were many times, obtained by the stealing mail from mailboxes in and around Anchorage.

The defendants in the case had conspirators and other locations, such as Puerto Rico and New Jersey. They would have the fraudulently obtained tax refund checks mailed to Anchorage using false names. The fraudulent tax refund checks were negotiated by the conspirators using the help of corrupt bank employees in Anchorage.

In order to negotiate the fraudulent tax refund checks, the conspirators in the case, at times, used stolen information such as names, dates of birth, and Social Security numbers from applications made to the Alaska Department of Motor Vehicles.

Also included in the indictment were charges against various defendants for submitting false claims for refunds, possessing stolen mail, making false claims of US citizenship, committing passport fraud, making false statements to banks and credit unions, passing forged U.S. Treasury debt, aggravated identity theft and drug charges.

Each of the fraud charges carries a penalty of between two and 30 years in prison.

|

|

A number of the defendants had previously been charged with cocaine possession, conspiracy to distribute cocaine, and international money laundering. If convicted on those charges, the defendants face a mandatory minimum sentence of five years in prison.

The case was investigated by the Internal Revenue Service criminal investigation, US immigration and customs enforcement, the US postal inspection service, the US State Department’s diplomatic security service, and the Drug Enforcement Administration.

Assistance in the case was also provided by the US Attorneys offices of New York, New Jersey and the Eastern District of Pennsylvania.