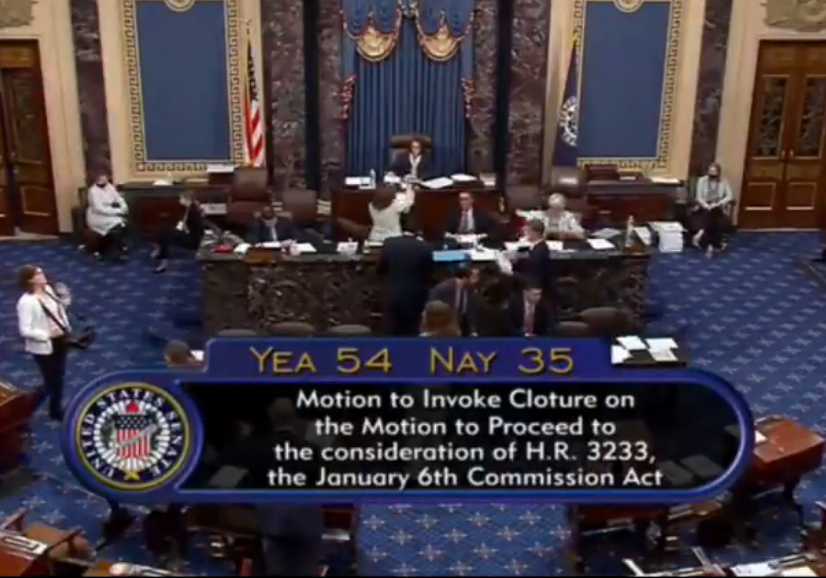

Today, in a 54-45 vote, the Senate rejected a motion to have legislation proceed on Student Loan interest rates. Those rates are due to increase on July 1st.

In order to move the debate on the student loan legislation, a vote of 60 was needed to block cloture, without that 60 member go-ahead, the Senate Democrats cannot proceed without a GOP filibuster.

Now the future of that legislation is in question, without action, interest rates for subsidized Stafford student loans will increase from 3.4% to 6.8% for 7.4 million students in less than two months. That legislation would have extended the current rates for one year.

The $6 billion extension offered by Senate Democrats would have been paid for by closing tax loopholes for S-Corporations. In general, S-corporations do not pay any federal income taxes. Instead, the corporation’s income or losses are divided among and passed through to its shareholders. The shareholders must then report the income or loss on their own individual income tax returns. In this manner, shareholders, who are many times, employees of the corporation can report those monies as profit and not earnings which lowers their tax burden. The loophole in question allows some shareholder-employees of S-Corporations to avoid paying Social Security and Medicare Payroll taxes on their earnings. This was rejected by the Senate Republicans.

The House has already passed its version of the legislation to keep student loan interests down. In their version, the House would pay for the extension by cutting funds for preventative health care under the healthcare law. House Democrats oppose that solution and President Obama has also threatened to veto that version if it were to pass. But, the likelyhood of the House version passing the Senate are nil.

Alaska’s Senator Mark Begich voted for the legislation, Alaska’s republican Senator Lisa Murkoski voted against passing the Student Loan bill extending present rates for another year.

In a short statement, Senator Begich said, “As the economy continues to recover, now is not the time to burden students who rely on loans to finance their education with an additional $1,000 in payments,” Sen. Begich said. “I am disappointed we did not move forward on this important legislation, and I am optimistic we can still come up with a solution that will help our young people.”

In a press release sent out after the vote, Senator Murkowski said, “College graduates in Alaska and across the country today face two obstacles: rising college costs and an incredibly tight job market. Everyone agrees that in these difficult economic times, we need to keep the interest rates on federal student loans low, but we disagree on how we pay for this fix.

“Today’s bill tries to solve one problem by making another worse. Raising taxes on prospective employers will only decrease the chances that they’ll be able to add jobs and hire young college graduates.

“Keeping loan rates low in the current fiscal environment shouldn’t dim anyone’s job prospects. There is another option out there that would pay for this by taking funds from the President’s health care bill while its fate remains in doubt – but that hasn’t been allowed a vote yet. I remain hopeful that between today and July 1st, a common sense bipartisan agreement will be found that doesn’t squeeze our vulnerable 20-something workforce more than they presently are.”