While a Gwich’in Steering Committee leader said the policy “is a first for the American insurance industry and shows leadership to protect sacred lands,” Chubb’s board opposes climate and human rights shareholder resolutions.

An Indigenous organization on Monday applauded Chubb for joining global insurers and major banks in refusing to underwrite new fossil fuel development within the Arctic National Wildlife Refuge in Alaska.

“After the Arctic Refuge was opened for oil and gas development, we have met with and encouraged financial institutions and insurance companies to respect the people who live and thrive off this land, which we consider very sacred,” explained Bernadette Demientieff, executive director of the Gwich’in Steering Committee.

“Since our first meeting, all corporate leaseholders have exited the refuge and every major U.S. and Canadian bank refuses to underwrite such projects,” she said. “Chubb’s policy is a first for the American insurance industry and shows leadership to protect sacred lands.”

“The Gwich’in and the porcupine caribou herd depend upon Iizhik Gwats’an Gwandaii Goodlit,” or the sacred place where life begins, “for our identity, our culture, and our ways of life,” Demientieff added. “We and the animals we care for are intrinsically linked to this land, and we are grateful to Chubb for this policy.”

The group pointed out Monday that though American International Group (AIG) early last month “announced a policy to not underwrite oil and gas projects in the Arctic, it was unclear whether this encompassed the Arctic Refuge,” and the company “has not responded to outreach from the Gwich’in Steering Committee and allies” seeking clarification.

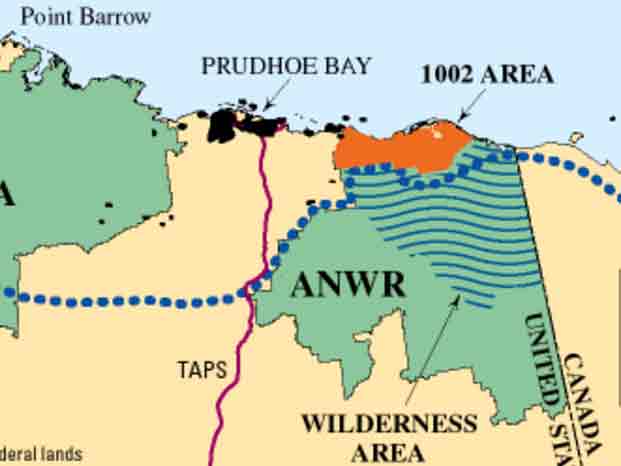

Chubb in late March announced new underwriting standards for oil and gas extraction projects. Along with adopting criteria for methane emissions, the company said at the time that “effective immediately, Chubb will not underwrite oil and gas extraction projects in protected areas designated by state, provincial, or national governments.”

In Chubb’s invitation and proxy statement for its upcoming annual general meeting, the company specifically mentions the Arctic Refuge:

Chubb has consistently been a proactive leader on climate risk management, including by being the first major insurer in the U.S. to announce a coal policy for its underwriting and investment activity in 2019; establishing an oil sands policy in 2022; adopting in 2023 a policy prohibiting underwriting oil and gas extraction projects in certain government-protected conservation areas, including the Arctic National Wildlife Refuge (ANWR), and we intend to develop further conservation criteria for the Arctic, mangroves, peatlands, key biodiversity areas, and recognized conservation areas that allow for resource use by the end of 2023.

That section of the statement details the Chubb board of directors’ opposition to a climate-related shareholder proposal from the legal advocacy group As You Sow, filed on behalf of Warren Wilson College and co-filers Jubitz Foundation and the Meyer Memorial Trust.

As You Sow’s proposal would require Chubb to issue a report disclosing medium- and long-term greenhouse gas targets for its underwriting, insuring, and investment activities in line with the 1.5°C temperature goal of the Paris climate agreement.

The company’s board claims that “Chubb shares the proponent’s goal of achieving a net-zero economy by 2050. We disagree that forcing Chubb to set targets related to the emissions produced by its insureds, rather than Chubb’s own emissions, would advance that goal.”

After the insurer unveiled its new underwriting standards in March, As You Sow president Danielle Fugere responded that “we are pleased to see Chubb begin to focus on climate and conservation-focused underwriting standards, yet question the impact these announced standards will have.”

“Most large oil and gas companies have programs in place for methane-related ‘leak detection and repair’ and programs related to the ‘elimination of non-emergency venting,'” she noted. “Whether Chubb’s policy will change the actions of oil and gas companies or Chubb’s own underwriting of oil and gas projects is therefore unclear.”

“Chubb’s own reporting will not answer that question,” Fugere added. “Chubb does not currently report the greenhouse gas emissions associated with its insuring, underwriting, and investing activities so the company remains largely unaccountable to investors with regard to its climate contribution or its reduction of greenhouse gas emissions.”