Program compensates communities for supporting the nation’s public lands, waters; invests in firefighters, police, schools and road construction

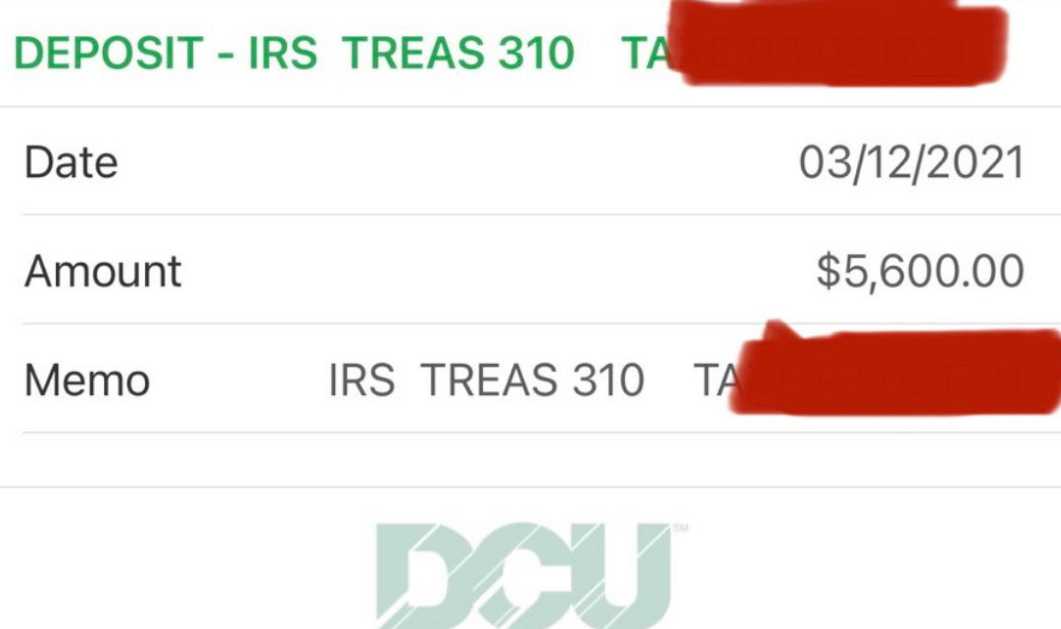

WASHINGTON —The Department of the Interior today announced that 30 local governments in Alaska will receive a total of $35.4 million in Payments in Lieu of Taxes (PILT) funding for 2023. Because local governments cannot tax federal lands, annual PILT payments help to defray the costs associated with maintaining important community services.

PILT payments are made for tax-exempt federal lands administered by the Department’s bureaus, including the Bureau of Land Management, Bureau of Reclamation, U.S. Fish and Wildlife Service, and National Park Service. In addition, PILT payments cover federal lands administered by the U.S. Forest Service, the U.S. Army Corps of Engineers, and the Utah Reclamation Mitigation and Conservation Commission. Payments are calculated based on the number of acres of federal land within each county or jurisdiction and the population of that county or jurisdiction.

“The Biden-Harris administration is committed to boosting local communities,” said Principal Deputy Assistant Secretary for Policy, Management and Budget Joan Mooney. “PILT payments help local governments carry out vital services, such as firefighting and police protection, construction of public schools and roads, and search-and-rescue operations. We are grateful for our ongoing partnerships with local jurisdictions across the country who help the Interior Department fulfill our mission on behalf of the American public.”

Since PILT payments began in 1977, the Department has distributed nearly $11.4 billion to states, the District of Columbia, Puerto Rico, Guam, and the U.S. Virgin Islands.

The Department collects more than $26.3 billion in revenue annually from commercial activities on public lands. A portion of those revenues is shared with states and counties. The balance is deposited into the U.S. Treasury, which, in turn, pays for a broad array of federal activities, including PILT funding.

Individual payments may vary from year to year as a result of changes in acreage data, which are updated annually by the federal agency administering the land; prior-year federal revenue-sharing payments reported annually by the governor of each state; inflationary adjustments using the Consumer Price Index; and population data, which are updated using information from the U.S. Census Bureau.

A full list of funding by state and county is available on the Department’s Payments in Lieu of Taxes page.

###[content id=”79272″]