Anchorage, Alaska — This tax season, Better Business Bureau Northwest & Pacific warns the public about the dangers of tax identity theft. This warning is in alliance with Tax Identity Theft Awareness Week, which runs from Jan. 29 – Feb. 2, 2018. The public is urged to be vigilant with their personal information so they don’t fall victim of tax identity theft.

Here’s how the scam works:

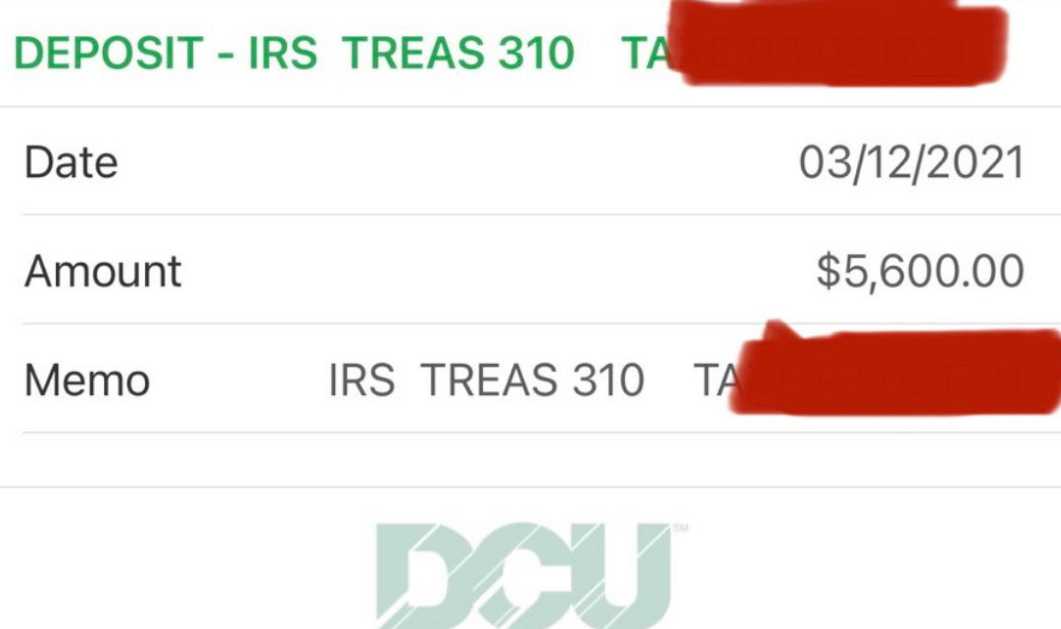

Tax identity theft occurs when someone gets access to your Social Security number and uses it to get a tax refund or job. You’ll discover it occurred when you receive a letter from the IRS stating more than one tax return was filed in your name, or IRS records show you have wages from an employer you do not know.

A recording of a real tax scam call can be found at https://bit.ly/2DSj9QD. Please listen and share the call with your contacts to help combat this con. If sharing on social media please use the hashtag #BBBFightsScams to help raise public awareness.

Be wary of unsolicited phone calls, emails or letters purported to be from the IRS or any official-sounding government agency.

Watch for these common tax related scams:

- Impostor Scams: Scammers pose as IRS agents and pressure victims by demanding money or threatening jail time. Fraudsters may spoof phone numbers, so the call appears to be coming from the IRS or local law enforcement.

- Tax Relief Scams: Watch for deceptive advertisements claiming to reduce a person’s tax liability greatly. Scammers will use official looking IRS notices or websites to sway people into paying unnecessary money or divulging private and personal information.

- ID Theft: Scammers use stolen personal information, social security numbers and falsified W-2 information to file fraudulent tax returns in the victim’s name. In some cases, thieves stole W-2’s out of unsecured mailboxes.

To protect your identity this tax season, take the following precautions:

- If having your taxes prepared for you, be sure to use qualified preparers and make sure they include their Preparer Tax Identification Number (PTIN).

- Be wary of preparers who guarantee high value tax returns.

- Be cautious of preparers who tell you that you need to obtain other services from them in order for them to complete your taxes. Other services may be notary services, immigration services or sending registered letters.

- E-file only from secure computers. Make sure anti-virus software is up-to-date and never use public Wi-Fi to file tax returns.

- Don’t file taxes from a link in an email.

Consumers can report a scam to the Federal Trade Commission or the Attorney General. To find a trusted tax preparer visit go.bbb.org. [xyz-ihs snippet=”Adsense-responsive”]