An unprecedented leak of the personal federal tax data of thousands of Americans has turbocharged a debate over wealth inequality in the United States and has tax reform advocates hopeful that a deeper public understanding of how the wealthy avoid taxes will lead to a restructuring of the U.S. tax code.

The data, leaked to the nonprofit journalism organization ProPublica, includes detailed information on the tax filings of thousands of the wealthiest individuals in the country and extends over more than 15 years.

This week, ProPublica used the data to give the nation its first detailed look at the extent to which the wealthiest in the United States are able to live lives of extraordinary privilege and luxury while simultaneously paying low rates of income tax or no income tax at all.

Among the findings is that Amazon founder Jeff Bezos, the wealthiest person in the world, according to Forbes magazine, paid no federal income taxes in 2007 and 2011, and that other billionaires with household names — Warren Buffett, Mark Zuckerberg, George Soros, Michael Bloomberg, Carl Icahn and others — managed to pay very small amounts of taxes to the federal government, or none at all, even in years when their wealth grew by billions of dollars.

Income vs. wealth

It is important to note the difference between “income” and “wealth” for purposes of the tax code. When an individual files a tax return, it is income that the government is measuring — the proceeds of wages, interest and business activities. Wealth, by contrast, encompasses not just money saved from income from labor or interest, but capital holdings — stocks, bonds, real estate — that may appreciate significantly in value but do not produce income until they are sold.

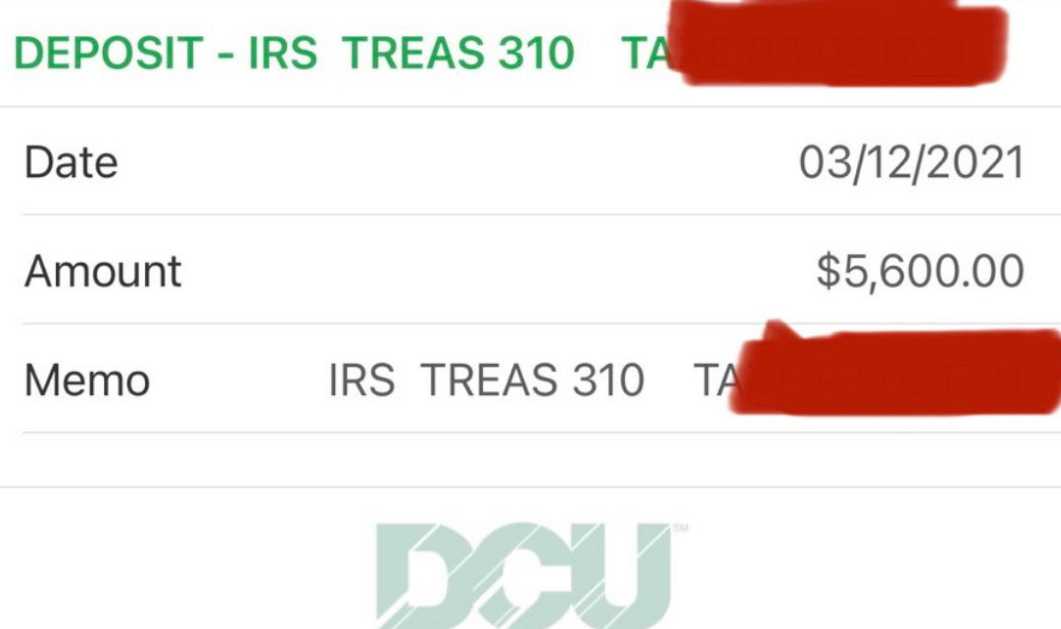

According to the report, the data show that the 25 richest people in the U.S. saw their wealth increase by a combined $401 billion between 2014 and 2018. But over that period, they paid only $13.6 billion in taxes, or about 3.4% of that increase. That’s because they were taxed only on money that counted as income, which in most cases represented only a tiny percentage of the increase in their total net worth over that period.

By contrast, the median U.S. household pays about 14% of annual income in taxes every year. According to ProPublica’s research, over the same five-year period, the wealth of the average American middle-class family increased by about $65,000, largely because of rising home prices. But that increase in wealth was very nearly balanced by the families’ $62,000 in tax payments across those years.

Monetizing unrealized gains

The ProPublica data illustrate how the very wealthy are able to minimize income, even as they continue to spend lavishly.

In brief, the strategy is to borrow money using their wealth as collateral. Oracle founder Larry Ellison, for example, has a $10 billion credit line collateralized by the same amount of Oracle stock in his possession. Because the money drawn from that credit line is considered a loan, not income, Ellison pays no tax on it.

In theory — and probably in practice, experts say — Ellison and others can simply continue rolling over their debt throughout their lifetimes, absorbing the interest costs from the loans but never selling the underlying assets.

Shocking, but not so shocking

The information uncovered by ProPublica was shocking insofar as individuals’ tax data are very closely held by the Treasury Department and are virtually never released publicly. However, the degree to which the very wealthy are able to avoid paying taxes and the methods they use to do so were not particularly surprising to those who study the tax code.

“Tax scholars thought that this was the way it worked — that they have large assets, and they borrow because the incentives to do so are gigantic,” said Zachary D. Liscow, an associate professor at Yale Law School. “We already knew that. It’s public information when they sell [their shares], and they just haven’t sold that much. Yet they live these lavish lifestyles, which suggests that they are borrowing.”

“I think it’s a big wake-up call,” said Steve Wamhoff, director of federal tax policy for the Institute on Taxation and Economic Policy in Washington.

“It tells us things that tax experts have already known for a long time. But it’s the amount of detail, the specific names, that we don’t normally see,” Wamhoff said. “Even though we know really wealthy people have all kinds of ways to avoid taxes, there’s something about seeing actual names and actual numbers that brings that into sharper focus, and makes people think about what a problem that is, and what we can do to fix it.”

Reason not to sell

There are very obvious reasons why the owners of large paper fortunes prefer not to realize their gains by selling their holdings. The appreciation of the stock would be subject to taxes, immediately wiping out a substantial amount of their wealth.

However, if a wealthy individual holds on to stocks until death, the person’s heirs are able to inherit the holdings at their present value — a practice known as a “step-up-in-basis” — that essentially erases any tax liability that the appreciated shares had come to represent for the deceased.

In this scenario, the heirs can then sell some of the shares with little or no paper gain, use the proceeds to pay off the estate’s outstanding loans and whatever estate taxes are due, and start the whole process over again.[content id=”79272″]

Policy implications

The wealthiest Americans are sitting on $2.7 trillion in unrealized capital gains, according to Emmanuel Saez and Gabriel Zucman, economists at the University of California-Berkeley.

If there are $2.7 trillion in unrealized capital gains that could somehow be subject to income tax — particularly at the 39.6% marginal rate that President Joe Biden’s administration supports — that would translate into more than $1 trillion in revenue for the federal government.

“That is a large share of the federal budget,” Liscow said. “The scope for what could be funded, or the taxes that could be reduced to middle-class families, is gigantic.”

Tax proposals

Exactly how to get at that money, though, is unclear. The kind of wealth tax that many on the left are interested in implementing has proven hopelessly complicated to administer in other advanced economies, like France.

Another option — taxing the wealthy on the money they take in via loans against their holdings — would require substantial revision to the tax code.

What advocates are most hopeful about is that the ProPublica revelations will add momentum to a push to do away with the stepped-up-basis enjoyed by the heirs of the ultrawealthy. The Biden administration has proposed just such a move alongside its budget request.

“So, at least all of that would be taxed, eventually, under the Biden proposal,” said Wamhoff, “which is the very minimum that we can do to crack down on this.”

Pessimistic note

However, Liscow said he was doubtful that the revelations would spur any other major reforms in tax policy.

In May, he and Edward G. Fox, an assistant professor at the University of Michigan Law School, released a draft of a paper documenting a survey of approximately 5,000 people, done to gauge support for how the United States taxes returns on investment. The results found broad support for a system that taxes gains only after they are realized.

Even when presented with a scenario mirroring the ProPublica report, in which a wealthy individual borrows against large unrealized gains, a majority of respondents did not support the idea of levying a tax on the borrowed funds.

While he said he personally thought the very wealthy should pay more, Liscow said, “Am I hopeful that this will substantially move the needle? No, I’m not.”

[content id=”52927″]