“House Republicans want to return to the lawless days of rampant tax evasion by the nation’s wealthiest.”

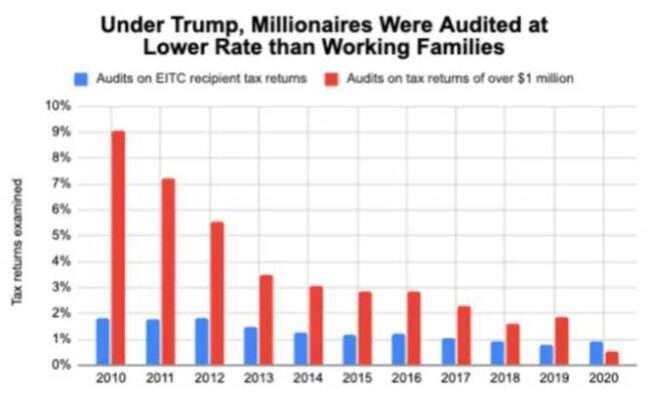

During the final year of Donald Trump’s presidency, the Internal Revenue Service audited low-income families at a higher rate than millionaires for the first time, according to an Americans for Tax Fairness analysis released as congressional Republicans work to further hamper the agency’s ability to crack down on rich tax cheats.

Years of Republican-imposed budget cuts have left the IRS badly understaffed and without sufficient resources to aggressively pursue wealthy tax evaders, whose returns tend to be more complex.

As a result, ATF noted in its analysis, “audits of millionaires have dropped 92% over the last decade.” Audits of Earned Income Tax Credit (EITC) recipients have also fallen over the past 10 years, but not nearly as dramatically.

In an effort to reverse the damage done by chronic underfunding, Democratic lawmakers and President Joe Biden approved an $80 billion budget increase for the IRS over the next decade, money that has already helped the agency increase its full-time staff, improve customer service, and collect tens of millions of dollars in delinquent taxes from rich Americans.

But that hasn’t stopped Republicans from attempting to roll back the agency’s recent budget increase and drumming up hysteria about armed IRS agents targeting ordinary Americans.

Across their appropriations bills, House Republicans have proposed $67 billion in IRS cuts, which would add to the deficit by undermining the agency’s ability to pursue wealthy tax dodgers. The House and Senate must pass appropriations bills to fund the government and avert a shutdown next month.

“Extreme MAGA Republicans are demanding that their rich donors get a green light to evade taxes as the price of keeping our government open,” said David Kass, ATF’s executive director. “Just as restored IRS funding contained in the Inflation Reduction Act that President Biden and congressional Democrats enacted last year is beginning to bear fruit in the form of tougher tax enforcement on wealthy and corporate tax cheats, House Republicans want to return to the lawless days of rampant tax evasion by the nation’s wealthiest.”

ATF’s analysis, released last week, shows that U.S. millionaires are now audited less than 1% of the time despite receiving a sixth of the nation’s total household income.

“Mega-corporations have also benefited dramatically in the past decade from an underfunded IRS,” the group observed. “Over the past decade, audits of corporations with over $1 billion of income have dropped 87%, to an historic low. Audits of corporations with over $100 million of income have dropped by 91%.”

Common Dream’s work is licensed under a Creative Commons Attribution-Share Alike 3.0 License. Feel free to republish and share widely.

[content id=”79272″]