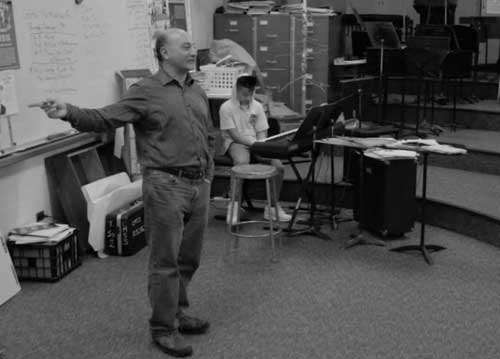

Representative Les Gara (D-Anchorage) said today the public should know the Parnell Administration never revealed a special interest provision in Senate Bill 21 that nets Alaskans nearly no production tax value, or even a negative worth for Alaska’s oil. “Negative or zero oil tax value on all future oil fields, and all fields after 2003, was never once mentioned in a legislative hearing before SB 21 passed,” Gara, a House Finance Committee member, said.

“If Alaskans had known they’d receive little or nothing for every oil field put in production after 2003, and all new oil, they never would have allowed that bill to pass. A zero-value tax is a recipe to continue firing teachers, draining savings, and cutting construction, public safety and thousands of other important jobs and economic development,” said Gara, who filed legislation to get Alaskans a fairer share, and provide industry with smarter, more effective investment incentives.

The provision of SB 21 that gets the state a near zero or negative production tax worth is reported in a little-mentioned section of a report touted by the oil industry and written by Scott Goldsmith. His report on this so-called “Gross Value Reduction (GVR)” provision shows Alaska gets nearly nothing, or even gets a long term negative production tax value because of deductions and tax credits that exceed the worth of oil at this low tax rate. The GVR applies to all oilfield units approved after January, 2003, and all new fields in the future. “It will bankrupt us, for fields that have been under exploration and development under ACES, and that continue to move forward.”

“Perhaps the most offensive example of this is Exxon’s Point Thomson,” Gara said. “That field sat illegally idle for 30 years until, under the previous tax law – “ACES” – the state took legal action to force Exxon to move ahead with development and production. Exxon gets a reward for breaking the law,” Gara said, noting the settlement during ACES that forced Exxon to develop Pt. Thomson.

Those units include many that went into production under ACES after 2003, fields companies announced they were developing towards production during ACES, fields that will be in production soon, and all future fields. Goldsmith states these fields are taxed at a 13% tax rate, or one of the lowest rates in the world, which barely or never covers the state’s up-front costs paying for development of these fields with tax rebates and deductions.

“As older fields decline, and post-2003 oil fields take their place, Alaska’s effective tax rate will fall towards this fire sale rate of 13%,” Gara said. “Pre-2003 fields pay a rate Goldsmith estimates, at current prices, of approximately 27%. That rate will keep falling as post-2003 oil replaces declining oil from pre-2003 oil fields.”

![OP/ED:State Invents New Numbers On $ Loss From New Oil Tax Law [signed] Les Gara](https://www.akdemocrats.org/images/signatures/5.jpg)